Business Insurance in and around Carrollton

Carrollton! Look no further for small business insurance.

Helping insure small businesses since 1935

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes hard work, commitment, and quality insurance. That's why State Farm offers coverage options like worker's compensation for your employees, extra liability coverage, a surety or fidelity bond, and more!

Carrollton! Look no further for small business insurance.

Helping insure small businesses since 1935

Protect Your Future With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a psychologist office, a beauty salon or a veterinarian. Agent Carol Martinez is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

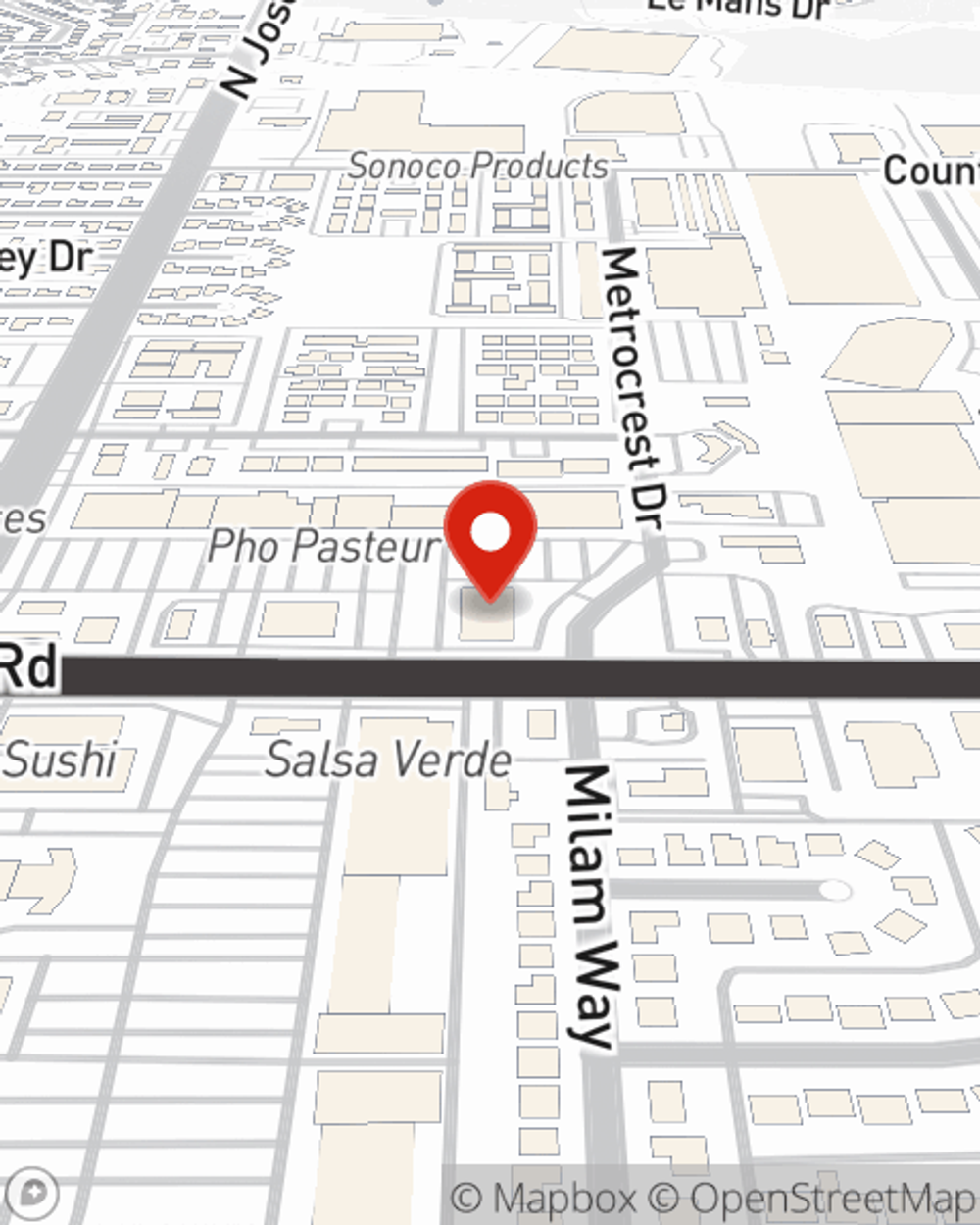

Get right down to business by contacting agent Carol Martinez's team to discuss your options.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Carol Martinez

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.